Home » BLOG » Uncategorized » A Strategic Perspective: Why strategy matters most in the ‘New World Order’

A Strategic Perspective: Why strategy matters most in the ‘New World Order’

Chapter One of Client Strategy in a Changing Legal Market report

Why strategy matters most in the ‘New World Order’

Since the collapse of Lehman Brothers at the end of 2008 which sparked the worst global recession in recent history, law firms have been reeling from a combination of the economic pressure that has been created compounded by wider structural and competitive changes. An industry which had become accustomed to year-on-year growth, firms which had expanded to become large corporates in their own right and individuals whose personal wealth had amassed to levels which would have seemed impossible only a generation earlier, all had to recalibrate – and quickly.

The boom years have also seen the growth of another important constituent of the legal industry – the in-house counsel community. Corporates faced with ever escalating legal bills, increased regulation and the need for legal advice permeating throughout their businesses, seek to gain increased oversight and control, and the mechanism of choice was the creation (or expansion) of in-house departments. With increased sophistication in the purchasing decision, firms were already facing rising costs of doing business before the impact of the recession with fierce competition between firms for a decreasing volume of legal services and a commensurate downward pressure on fee levels.

As we emerge from the recession, it is clear that clients want their legal services delivered better, faster and cheaper. Competition is high, supply outstrips demand and the threat of new entrants in a range of guises as a result of the profession’s deregulation threatens many firms of all sizes. Whilst the UK legal services market is in the vanguard of these deregulatory changes, it would be wrong for other jurisdictions to see themselves exempt from similar changes. The hard reality is that in an increasingly global business environment, it will be more and more challenging for such regimes to survive in the longer term. Deregulation of other legal services markets may not happen in the immediate aftermath of the LSA taking effect in the UK in October 2011, but it should be anticipated in the medium to longer term that lawyers in other jurisdictions will begin to experience the same competitive pressures now felt in the UK market.

These are the ingredients of the competitive mix that the leadership teams of law firms must now contend with – far-reaching changes in the nature of the client, increased competitive pressure catalysed by the recession and fuelled by innovation, an increasingly commercial approach and, finally, the challenge of engendering change within the firm in order to create a position of sustainable competitive advantage. These are the firms which remind us of the words of Brock Lovett, the treasure hunter in the film Titanic1:

“26 years of experience working against him. He figures anything big enough to sink the ship they’re gonna see in time to turn. The ship’s too big with too small a rudder. It doesn’t corner worth a damn. Everything he knows is wrong.”

To survive and to prosper, law firms need to put to one side the taken-for-granted assumptions that have served them well and come to terms with a new paradigm. Helping the leaders of law firms to create frameworks for thinking in order to better understand these challenges and the options open to their firms is at the core of this report. How some of the leading thinking in the profession is changing the nature of the competitive map is examined – allowing some firms to strike out in exciting new directions whilst others remain mired in their history. There is, no matter what some advisers to the profession may suggest, no ready-made answer to these questions. Indeed, if there were, it would not be a good sign for firms since, at its most fundamental, every firm adopting the same strategy can only lead to price wars since there will be no basis for strong differentiation. Each firm has its nuances which sets it apart from others, a different set of strong skills (or core competencies) and a client base, or potential client base, that will allow it to create a defensible position. But it should also be understood that, just as in other industries, the market position that a firm adopts will have an inherent impact on its absolute profitability as well as its longer-term viability.

The question then moves to the subject of numbers of equity partners (akin to the number of shares in issue in a corporate context). In the same way that many strategists will argue that share buy-back is not a sustainable model, so it is suggested that simply reducing the number of equity partners is an unsustainable approach for law firms. Whilst some partnerships may have become bloated during the boom years and harder economic times have inevitably raised the bar in terms of partner performance expectations, it is unrealistic to think that individual partner profit shares can be maintained in an environment in which profitability is being eroded without significant increases in turnover.

If one accepts the logic of this rationale, then the options remaining to the firm require it to develop a strategy which aligns its client opportunities, its business model and its competitive position.

But what is strategy?

It is important at the outset that we have a clear understanding of what we mean by strategy and in particular its role in the context of client development. With its genesis in military circles, the development and implementation of effective strategies sit at the core of business success.

In simple terms, a strategy is the means by which we achieve an objective. This can be a cause for confusion since many state their objectives as their strategy, for example ‘to be the leading firm in …’ or ‘to increase turnover to …’ Such statements talk about the destination, not the journey. There are a number of schools of thinking which are relevant to a law firm considering its strategic next steps. Each has advocates and detractors, strengths and weaknesses. Within this report we will draw on a number of these to illustrate how they have relevance to law firms charting a course through increasingly challenging commercial waters.

A competitive perspective

The ‘Competitive Strategy’ school flowing from the work of Michael Porter has relevance to law firms in a number of respects. It is founded in the belief that strategy must seek to create a compelling advantage – most often achieved by interlinking a number of discrete aspects or processes to form a unique value chain for an organisation – that is both valuable to a client and difficult or impossible for competitors to imitate. Porter2 suggests six characteristics of a compelling strategy:

- It creates a unique competitive position for the company;

- Activities are tailored to the strategy;

- There are clear trade-offs and choices made vis-à-vis competitors;

- Competitive advantage arises from fit across activities;

- Sustainability comes from the activity system, not the parts; and

- Operational effectiveness is a given.

A common misconception is to state strategy simply in terms of improvements to operational effectiveness. It will be clear to the observer of the legal market that a significant proportion of headline grabbing moves of the last two years have really been centred on improving operational efficiency (or reducing costs, to be more accurate). In themselves they will not alter the fundamental competitive positions of firms in a peer group since they are relatively easy to imitate. Although the first mover will gain some advantage, in the medium term such gains will be short lived. Whilst operational effectiveness is crucial, and never more so than in the current climate, it does not in itself represent a strategy that leads to sustainable competitive advantage.

Core competencies: Maximising the assets that make the firm unique

Taking a typical law firm we should also consider the role of core competencies, a concept first put forward by Gary Hamel and CK Prahalad in ‘The core competence of the corporation’3. This theory encourages strategists to consider their firm not as a collection of discrete practice groups, offices or sector teams but as a portfolio of core competencies. The thinking that drives core competency theory goes to the essence of a law firm’s collective knowledge and culture. They represent the things which are unique about the firm and which permeate all aspects of its operations and client interactions. The metaphor used by Hamel and Prahalad is that of a tree. In a law firm context, the trunk and major limbs represent the core legal skills, client management capabilities and project management attributes needed by any lawyer; smaller branches symbolise practice groups with the leaves and fruit signifying the specific services offered to clients. Giving everything stability and providing energy and renewal is the root system – the core competencies. For many firms, strategy must blend the concept of opportunity-fit with that of competencystretch.

Having identified new client or market opportunities it is often not a simple task to re-engineer the firm to provide an alluring competitive fit. Firms are constrained by relative inertia in introducing but the most advanced firms and whilst lateral hires, team acquisitions and larger mergers are increasingly common within the law firm environment, they are all time consuming when compared with more fleet of foot businesses. It will often be more feasible to view nascent opportunities in the context of existing skills and competences – seeking out ways of stretching these to meet the new opening may produce a more viable strategic route.

‘Simply Better’

The work of Patrick Barwise and Sean Meehan expounded in Simply Better: Winning and Keeping Customers by Delivering What Matters Most4 builds on these ideas of identifying a number of key aspects of product or service and outperforming the competition incrementally. It is founded on the proposition that in sophisticated markets there is no single ‘killer app’ or silver bullet that will build enduring and significant competitive advantage, but rather that world leading organisations build their position by being better, sometimes only marginally so, across a range of performance factors. In this way they do not need to have a single point of differentiation but simply outscore the competition across the board in ways which in themselves are relatively small but, put together, become compelling. They are simply better.

The metaphor that we use for this approach is that these strategies are based on recipes, not ingredients; this concept is discussed further in Chapter 5.

‘Blue Ocean’ approaches

Another school of strategic thinking that is relevant for our purposes is that proposed by W. Chan Kim and Renée Mauborgne in their ground breaking work headlined in Blue Ocean Strategy: How to Create Uncontested Market Space and Make the Competition Irrelevant5. It is possible to see their theories being used by some law firms that are pushing the innovation envelope with potentially dramatic effect; we shall examine these in more detail later in this report.

At this point, the key aspect of a Blue Ocean approach that readers should appreciate is that it seeks to create new market space by employing, inter alia, an analytical tool called the value curve to assess new ways in which client value can be created. In this way, firms employing these strategies are able to move away from the red oceans (metaphorically filled with the blood of firms competing head-to-head) into those where competition is less intense.

As with all approaches to strategy, Blue Ocean theory requires choices and trade-offs – what not to do any more, what to do less of, what to do better and which new service aspects should be created that are not offered elsewhere and which will be attractive to clients and add value to the firm’s overall proposition.

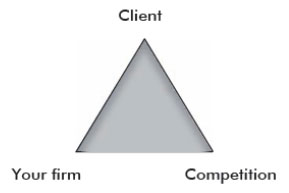

The ‘Strategic Triangle’

A simple yet effective model that any strategist should hold to the forefront of their mind is the Strategic Triangle first suggested by Kenichi Ohmae6 and illustrated in Figure 1.

Figure 1: The Strategic Triangle

Ohmae suggests that strategy should be viewed as a triangle with the client, the firm and the competitors at each apex. He postulates that all strategy must respond to this triangle and that the appropriate strategic options are defined by a deep understanding of the inter-relationships between each of the combinations of apices – the firm and its clients, the firm and its competitors and, finally, the relationship between clients and competitors. From the competitor perspectives there are clear references earlier in Japanese history to the importance of this aspect of strategy. In the sixth century BC, Sun Tzu7 said:

“If you are ignorant of both your enemy and yourself, then you are a fool and certain to be defeated in every battle. If you know yourself, but not your enemy, for every battle won, you will suffer a loss. If you know your enemy and yourself, you will win every battle.”

From a law firm perspective, understand what drives client loyalty and how your firm scores on these criteria, be prepared to align your processes and systems to improve performance in the areas most critical to clients, evaluate your own performance against that of competitor firms on these key criteria and develop intelligence to mine relationships and analyse competitor capabilities. These are the strategy themes that form the underpinning theory for the remainder of this report. We shall return to them at points throughout the text that follows in greater granularity but they have been presented here to provide the canvas on which a client strategy is painted.

Adopting a model for strategy development

There are numerous models of the strategy development and management process. The one often favoured is derived from that first suggested by Johnson & Scholes8 because it has been found to be particularly suited to use in a professional services environment, especially in the conduct of leadership group planning workshops. This is because in one simple diagram the model is able to comprehensively illustrate both the overall strategy process and the nature and inter-connectedness of its constituent parts. Figure 2 is an adaptation of this model, and the first three stages of a typical strategy development process are highlighted. These are the elements on which a strategy review will typically focus in the planning stages. Of course, it is in their implementation that many strategies come unstuck and, within this report, balance will be given to both the planning and implementation aspects of the process in due course.

Figure 2: The strategic management process

Analysis is the starting point of any strategy and requires firms to develop a clear understanding of their client and service opportunities, the competitive context in which they operate and their own capabilities and desires. We shall return to the importance of this triumvirate later but at this stage it is important to appreciate the scope of the analysis that should be undertaken to fully assess the opportunities and threats that the firm faces, along with a competitive appreciation of its relative strengths and weaknesses. Figure 3 illustrates a range of the areas that any comprehensive review will need to consider. There are a number of areas in which detailed analysis and insights will be required, for example:

- How well are current clients and sectors understood? Do we know enough about the competitive pressures that they are facing and how this might impact on their use of lawyers?

- What sectors and clients are emerging on which we might focus our efforts? What skills will they require that we currently do not have and how should we go about developing them?

- Where are we prepared to trade off opportunities in order to deploy scarce resources to the maximum effect?

- How well do we understand our own performance when viewed through the eyes of the client and a competitive lens?

- What non-legal services do we need to develop in order to underpin our brand proposition? and

- How well do we understand our current and emergent competitors? What do we need to do to ensure that we can counter any competitive threat and gain advantage in areas which are of high importance to our clients?

All of these points are key strategic issues for the longer term direction of the firm but the area of most importance is that concerning expectations, objectives and power. It is in this area that we move from objective (or at least quasi-objective) analysis of firm, clients, sector and competitors into the subjective issues of values, aspirations, culture and ambition.

There must be cohesion from the leadership team on the ‘big questions’ such as:

- What sort of firm do we want to be (and as a corollary, what do we not want to be)?

- What services shall we offer (and as a corollary, which shall we not offer)?

- What clients and sectors shall we target (and as a corollary, which shall we not target)?

- How much shall we demand of each other? How should we recognise and reward performance? How should we deal with underperformance?

- What values do we hold dear and which are not tradable for any commercial opportunity? and

- What are the key elements of our brand proposition to clients and how will we align our management, communications, processes and systems to ensure that we ‘walk the talk’ of our brand?

These are the areas (together with the management and governance implications which flow from them) that will often present the biggest challenge to the strategy team. They are also issues that are fundamental to the long term success of the firm and a meaningful consensus must be achieved as to the future direction and focus of the firm, the clients that it wishes to serve and the way in which it will go about delivering that service. It should also be clear that, in order to reach such unanimity, it may be necessary for those unable to accept these changes to leave in order to seek out firms whose particular vision is more aligned with their own.

Choice is the essence of any strategy, and it is an uncomfortable truth for many whose careers in the law have been forged in an essentially generalist partnership model that such choices will mean saying goodbye to colleagues whose skills or working methods are not what is required in the firm going forward.

‘Get big, get niche or get out’

The business school phrase ‘get big, get niche or get out’ may have become clichéd but it still resonates with the position in which firms in mature markets find themselves. Unless, through scale, one can dominate a particular market the only other option that is viable in the longer term is to identify a niche position in which price can be shored up through offering specialised added value services. Being mid-market and without any clear source of differentiation will inevitably lead to profit erosion as pricing pressures mount. At its most simplistic, this is because firms in this unenviable position have no basis to compete except on price.

The effect of the ‘get big, get niche’ philosophy can be seen clearly in the profit reporting of the UK 200 top firms. When sorted by profit per equity partner (PEP), a clear correlation in superior profit can be seen between those firms with scale and those with a clear focus to their business (and in some cases those with both). It is also interesting that there are a number of large firms which lack clear focus, operate in the mid-market and are unable to offer unique services. Their ratio of PEP to turnover is lower than their peers on a revenue ranking. It is vital for these firms that they create a distinctive service proposition and we shall see later in this report the innovative approaches that some of them are adopting.

Another example of this characteristic in play can be seen in the client attractiveness of a postmerger firm. This larger firm will find itself able to attract work of a higher quality than either of its antecedent organisations. The glass ceiling will have been raised. Paradoxically, it will often be the same personnel engaged in undertaking the higher value work that would have been engaged in the antecedent firm. The resources employed on the client’s behalf have not changed but the client’s perceptions have. With greater strength in depth, a higher profile brand and improved infrastructure, the new firm is seen as a safer bet for higher value work. How much of this is a psychological effect as opposed to one which can be delivered in practice during the early months post-merger is a moot point; it is a noticeable effect nonetheless. All roads lead to service…

Generic strategy models suggest that there are two fundamental options which may be adopted by any business looking to create a defensible market position: become the lowest-cost producer or adopt a basis for differentiation in some way (with a niche strategy being a highly focused form of this second approach). Let us consider each in term through the lens of a typical law firm.

The low cost producer position is generally unattractive to law firms from a cultural and organisational perspective. The traditional self image of a lawyer does not sit well with a culture that engineers every cost to the minimum level. To succeed in this market position means that the whole business is structured to minimise the costs of production with actions such as:

- Out of town premises;

- Activity carried out by the cheapest staff possible to undertake the task in hand;

- Heavy reliance on process;

- Limited task freedom for individuals; and

- Efficiency built on repetition.

It will be clear to the reader from this schedule that there are very significant challenges in a law firm founded on a traditional model adopting such a market position as its primary proposition. The other important consideration of adopting a cost leadership position is that, necessarily, there can only be one cost leader which will win every battle in which price is the only consideration.

Consequently, even in this highly price driven part of the market, additional service factors will still be at play. However, whilst very few firms will adopt a lowest cost producer strategy as their outward facing proposition the same cannot now be said of internal operations and efficiency improvements. We shall see later in this report how trends such as process re-engineering, offshoring, legal process outsourcing (LPO) and the innovative use of IT are being employed by firms to lower costs of production in an effort to respond to client pressures for lower prices and at the same time maintaining acceptable levels of profitability. These approaches, combined with culling the equity partner base, are seen as a way of maintaining PEP at the levels to which the profession has become accustomed.

A strategy of differentiation offers much more appeal to the professional with its implication of a uniqueness that is highly valued by a client, enabling the firm to charge a higher price for its services and to deliver those services from premises and using personnel at a level much more aligned to traditional norms. Unsurprisingly, then, almost all law firms pursue a strategy which is fundamentally forged in the principle of differentiation. How well they do this and how credible their proposition is are both moot points that we will reflect on later. Having arrived at a differentiation strategy as the means by which clients will be attracted to the firm, the next issue to consider is the basis of that differentiation. Law firms have two broad choices – to set out their stall as possessing unique technical skills or to offer a unique approach to service. Whilst a proposition associated with a unique technical capability will be intellectually appealing and pander to the ego of many lawyers, it is a challenging market position to adopt for several reasons, primarily because it is not factually correct for the vast majority of firms – the technical expertise that they possess is no better or worse than that of their peer group. Moreover, research evidence is compelling that clients will assume technical expertise within a given peer group of firms. This is not to say that a regional firm has the same levels of technical capability as an international firm but rather that, when compared to firms of a similar nature, the levels of expertise will be indistinguishable to all intents and purposes.

It should also be clear that, whilst a given, technical expertise should not be neglected, it is fundamentally necessary but objectively insufficient to deliver success. In this respect it falls into a category known to marketers as ‘hygiene factors’, based on the premise that good hygiene may have an important part in preventing illness but will not in itself promote good health. A common, and oft quoted, example of a hygiene factor is an airline’s safety record. Few passengers will check the safety record before booking a flight – it is assumed to be excellent – and will instead focus on aspects such as convenience, added services, timetable, proximity of departure and arrival airports and, of course, price. Should an airline’s safety be called into question, however, all other decision criteria will fall away and this will become the key factor. So it is with a law firm’s technical expertise; as an assumed competence it will not aid client acquisition and retention efforts but if it is called into question then the firm has significant commercial challenges just to stay in business. In this sense the technical expertise of a skilled lawyer underpins the rest of the firm’s offer.

‘Service differentiation’ is the other route to differentiation and is the stated strategy of most law firms.

Service differentiation refers to a strategy that adds value to the client experience by actively and deliberately managing the way in which the service is delivered. This is normally achieved through close attention to people, processes and systems. Implicit in any strategy of this nature is the ability of the firm to behave consistently in its strategy execution: the concept is simple but the execution is significantly more challenging. These positioning options are set out diagrammatically in Figure 4.

Figure 4: Positioning options

A service differentiation strategy is often articulated through an approach based on client intimacy. What client intimacy means in practice is that firms invest resources in areas such as the following.

Understanding clients’ businesses

Firms need to understand the business of their clients and issues in the sectors in which they operate. This must extend beyond an appreciation of how the law can be applied to a specific business situation and encompass a genuine interest in the commercial activities of their clients.

Such knowledge is also invaluable in allowing the firm to spot opportunities for their clients and themselves.

Being aware of relationship-changing factors

Firms should be responsive to emergent factors which will change the nature of their client relationships, and put in place action plans to mitigate threats and to capitalise on opportunities.

A focus on relationship management

A determined focus on relationship management will be evident from the leading firms. This will apply at both the level of key client management (where there will be a sophisticated programme in place to secure and develop these relationships) and in terms of the management of relationships and service delivery to the more general client base.

Resolving issues quickly

Any service quality concerns must be dealt with quickly. The evidence is strong that client loyalty can be strengthened by the way in which a firm resolves any issues that may arise from time to time in a relationship.

Being responsive

Responsiveness is a key service attribute that many firms find hard to hardwire into their processes and culture. Yet it is one of the most important attributes in driving client satisfaction. The leading firms are highly responsive, not by good fortune but through meticulous investment in the infrastructure drivers and cultural expectations that fuel this sort of performance. The same responsiveness is also deployed in dealing with opportunities to forge new relationships and develop new lines of business. It is a cultural trait that has benefits across the full width of the firm.

Treating clients as individuals

Clients are individuals and have a strong preference to be treated as such by receiving a customised service mix. This is a challenge for firms who see the cost advantages of standardisation. The answer lies in the ability to customise standard service elements as opposed to bespoking a service by investing new approaches on a per client basis, which is necessarily inefficient. The smart firm gets client-intimate by adopting an à la carte menu approach with a diverse (but ultimately finite) range of service options from which a client may select. This allows the firm to build an infrastructure that can efficiently deliver these options at a price point which clients are willing to pay whilst still preserving their own profitability.

Being easy to do business with

Firms that are client intimate are, above everything else, easy to do business with. They see the world through the eyes of their clients. They model their own business processes so that each interaction with the client is as straightforward as possible. By managing client touch points and actively engaging in reinforcing their relationship these firms create strong bonds of loyalty, maximising their share of work from their client base and making it supremely challenging for competitors to unseat them.

Having settled on a strategic position that is client centric, the law firm leader then needs to move to the creation of a brand and strategy that will support that position.

The importance of brand

The subject of brand is a vexing one for law firm leaders since all will eulogise about the importance of brand but many are mired in terms of how to build one.

This is primarily due to difficulties in matching brand promise with brand experience. By this, we mean having the strategic and operational capabilities to ensure that the firm can consistently create the client experience that marketing and promotional materials promise.

Perusing law firms’ corporate communication materials and browsing their websites is a pretty mundane pastime. In truth there are only so many ways in which even the most eloquent of wordsmiths can say the same thing over and over again. Taken at face value we live in a world inhabited by lawyers who are businesspeople in disguise, wholly commercial in their approach and clear communicators, getting to the core of the issue immediately, charging transparently and delivering to deadlines. All of this is surrounded by a ‘service wrapper’ that promises an experience like no other; indeed, one so good that the client will look forward to engaging their lawyers on a regular basis.

The source of this convergence of brand messages is clear. Firms and their marketing agencies have been investing in research to understand what clients value. The results of this research are then played back as a series of promises by the communications department in a seemingly neat resolution of the ‘what do we say to appeal to clients?’ conundrum. In simple (and perhaps somewhat cynical) terms, we take the approach of ‘telling them what they want to hear’. Of course, this approach is nothing more than a series of vacuous statements without substance unless a firm has put in place the operational mechanisms by which it can consistently ‘walk the talk’ of such promises. If not, these are optimistic assertions at best and plain misleading at worst.

This means that the leadership team needs to be clear about the brand marketing messages that it sends and to ensure that the firm can meet this benchmark consistently by managing the service delivery process far more actively than ever before. Close attention must be paid to developing the systems, processes and people skills that will ultimately determine the service quality received, and so shape the client’s experience. However, there is no doubt that the power of a well structured brand is compelling. As Gilligan and Wilson note in Strategic Marketing Planning9:

“Brands, which are in essence a form of shorthand that creates expectations about purpose, performance, quality and price, are therefore potentially enormously powerful and provide the basis not just for a high(er) profile in the market, but also for higher levels of [client] loyalty and the freedom to charge a price premium. Given this, the effective and proactive management of the brand is, for many organisations, essential.”

Trust is a very high importance component of a law firm brand. Given the intangible and complex nature of the service, the potential for far-reaching and serious consequences if the service is not delivered to the required standard and the high costs associated with engaging a law firm, it should not be a surprise that clients will attempt to make the lowest perceived risk decision possible. What this means in practice is that those brands which are strongly trusted will come to the fore. Law firms will often use proxies to demonstrate that they represent a low risk and high trust purchase. Such proxies will include, for example, credentials of similar work, existing client lists, directory rankings, industry awards, client testimonials and league table rankings. These all serve to reinforce client perceptions that a good decision is being made when the firm is engaged.

Investment in brand building is a long term game but the evidence is clear that strong brands outperform the market. In Expert analysis 1, Acritas – a leading market research company with a strong focus on the legal sector – discusses the findings of extensive research in how to build a world class law firm brand. Importantly, this empirical research links business growth with brand strength: “…there is an increasingly urgent need for law firms to understand the underlying dynamics that underpin the life cycle of the client–law firm relationship. A crucial stage in this cycle is clients’ awareness and recognition of what an individual law firm can offer, especially as globalisation and consolidation continue to shape the direction of law practice.

“Awareness and recognition are driven by a law firm’s brand. This concept is more than marketing theory, more than a name and more than a logo. It encompasses perceptions of the values a firm represents; the promises, both explicit and implicit that a firm makes to its clients; the reassurance that a firm can provide when clients trust it with matters of profound strategic importance; the extent to which the firm appreciates the business context in which legal decisions must be made, and how the firm’s lawyers define themselves as professionals. All firms send messages across each of these issues, whether they intend to or not, which means that all law firms have a brand.

“A strong brand is especially important as difficult economic conditions continue to pose substantial risk and acquiring business is even more challenging as the market for legal services increasingly becomes global.

“Empirical evidence shows that law firms with the strongest brands are more likely to achieve sustainable business performance, to be striving for world class standards and creating client centric business models. The brand leaders have in fact achieved 50% higher revenue growth than their Global 100 peers since 2007, with the top 6 Global law firm brands achieving almost double the revenue growth since 2007 of their Global 100 peers.”

A new client orientation

By far the bigger challenge for law firms lies not in the intellectual niceties of defining a strategic position, and strategy to support it, but in the delivery of that strategy in practice. The real challenge lies in areas such as:

- Confronting and changing the historic cultural norms of the profession which placed the client in a subservient position to the lawyer. A client based strategy means turning this position 180 degrees;

- Restructuring of internal processes to ensure that the client’s experience is of a high quality and consistently managed across the whole firm;

- Alignment of behaviours, recognition and reward systems with the desired client experience. Without definition of required behaviours, measure of performance against these yardsticks and a clear line of sight between such performance and the firm’s reward system, any initiative will fail;

- Introducing new working practices will mean careful consideration of systems and processes. They must walk the line of being as complex as necessary but as simple as possible if they are to succeed. Again, the key challenge will not be in the design of client facing methods but in their adoption by the firm’s people; and

- Firms will need to deal with managing change whilst still running a profitable business. Change is difficult but necessary in order to bring about the necessary reorientation. There are a number of well tested approaches to change management and an appropriate approach will be discussed later in this report.

Figure 5: Revenue growth of leading brands

To deal with these matters effectively requires both a clear plan (that can be delivered within the resources and capabilities of the firm) and a management team with the skills and determination to see that plan through to its conclusion.

Why client strategy should have a strong focus on retention The advantages of retention can be thought of in three main areas:

- Increased profitability over time;

- Client lifetime value versus ongoing acquisition costs; and

- The challenge of replacing a client base in a mature market and challenging economic conditions

Increased profitability over time

The evidence is strong that, with effective relationship management systems in place, the profitability of any client relationship increases over time. The sources of this increase in annual profit are illustrated diagrammatically in Figure 6.

Whilst it is still relatively unusual for law firm accounting systems and procedures to track profitability on a client by client basis (let alone moving to more sophisticated methodologies such as activity based costing) it should be intuitively apparent that the acquisition costs of a new client will affect the profitability of that relationship for the initial period. A reluctance or inability to track and quantify these costs, combined with the ego drive of many lawyers, has historically meant that the focus on new client acquisition in many firms has been too dominant. The converse was also true, with those tasked with ensuring that existing clients were effectively nurtured and developed being perceived as less important to the future of the firm. Of course, both professional personalities are vital to the longer term vitality of the business and firms now generally recognise and reward the contribution of a wide range of lawyers and non-lawyers to the broad health of the business.

Figure 6: Why clients are more profitable over time

During the initial years of a client relationship, additional contributions to profit will often arise from a combination of increasing the firm’s penetration of the initial service line sold together with improvements in efficiency as the firm and the client get to know each other. This will often lead to the development of a more bespoke service, streamlining of communications and creation of interfaces that benefit both parties. A successful relationship will often lead to opportunities to expand into other areas of the client’s business and to offer a broader range of services, without incurring the same level of initial acquisition costs that would result from pursuing a new client.

Finally the evidence is also strong that, approached correctly, there is the potential to achieve better pricing through longer term relationships where added value can be demonstrated. In times of austerity, this pricing advantage may be evidenced by the ability to hold prices or discount less rather than to change any premium above headline rates but, when viewed through a comparative lens, the annuity relationship carries pricing benefits when compared to those of a more transactional nature.

Overall, it is not unreasonable to say that the cost of winning a new client is around five times the cost of retaining an existing one. With the ratio at this level, the imperative to invest in effective relationship management strategies, systems, processes and behaviours is self-evident.

Interestingly, research conducted in the 1980s also suggested a strong link between relationship longevity and quality. Firms generally regarded as being of the highest quality also had the best metrics in terms of client retention. This should not be surprising – a quality service leads to satisfied clients who expand the range of services that they buy and are unlikely to defect.

Client lifetime value versus ongoing acquisition costs

Readers will no doubt have come across the somewhat apocryphal statement that ‘it costs eight times as much to win a new client as to retain an existing one’. Whilst the source of the statement is obscure and the ratio varies according to the telling from five to 12, the underlying economics are incontrovertible. Money spent retaining existing business, securing clients, deepening relationships and extending service lines purchased is much better spent than on a new client acquisition trail.

Of course, in a law firm context the other key resource is time (and especially partner time) and there would be strong consensus that, for most partners, a focus on current clients will reap greater rewards.

The concept of client lifetime value (CLV) is appealing to the strategist. In accounting terms it is the net present value of the cash flows attributed to a particular client relationship. In theory, this can then be used to guide the level of marketing investment that would be appropriate to secure the relationship. It has found favour in recent years in directing marketing strategy and the targeting of client groups which will generate high lifetime values (thereby increasing overall profits and reducing overall acquisition costs in both quantum and percentage terms). As a corollary, firms’ strategies will also seek to exclude client groups with low lifetime value. Within a commercial firm context, lifetime value may also be conceived in terms of the retention of corporate clients with recurring annual legal spend or alternatively their rate of churn or defection. The impact of this over time can be seen in Table 1.

Table 1: The benefits of retention

The challenge of replacing a client base

The challenge of replacing a client base The economy, heightened competitive forces and increasingly sophisticated purchasers all mean that, for firms with high client churn, finding new business to replace that which has been lost is very difficult. This is seen very clearly when one considers the large corporate which is a serial purchaser of a large range of legal services and with a significant annual legal budget. This is the client sine qua non of a successful corporate or commercial law firm. With knowledge of their importance to the firm, clients of this nature will often strike a hard bargain with their lawyers. However, this will generally be a better outcome for the firm than losing the entire book of business which is often the alternative scenario.

The commercial challenges faced by today’s law firms and lawyers with fierce competition, oversupply in the profession and alternative service providers on the horizon (or in some cases, already here) mean that a firm which does not build the bedrock of its business through client strategies based on retention will face increasingly difficult trading conditions.

References

1. Titanic, Paramount/20th Century Fox, 1997.

2. Porter, M., ‘What is strategy?’, Harvard Business Review, November-December 1996.

3. Hamel, G. and Prahalad, CK., ‘The core competence of the corporation’, Harvard Business Review, May-June 1990.

4. Barwise, P. and Meehan, S., Simply Better: Winning and Keeping Customers by Delivering What Matters Most, Harvard Business School Publishing, 2004.

5. Chan Kim, W. and Mauborgne, R., Blue Ocean Strategy: How to Create Uncontested Market Space and Make the Competition Irrelevant, Harvard Business School Publishing, 2005.

6. Ohmae, K., The Mind of the Strategist: The Art of Japanese Business, McGraw-Hill, 1982.

7. Tzu, S. and Minford, J., The Art of War, Penguin Group, 2009.

8. Johnson, G. and Scholes, K., Exploring Corporate Strategy, Prentice Hall, 2006.

9. Gilligan, C. and Wilson, R., Strategic Marketing Planning, Butterworth-Heinemann, Oxford, 2009 (2nd edition).

You may also like

Search

Categories

Recent Posts

- Fighting fit

- The Challenges Of Leadership Are Different To The Challenges Of Management

- The Cultural Dimensions Of Leveraging Institutional Knowledge

- A knowledge-led approach to business development is key to law firm resilience

- Team Morale Is Directly Linked To The Ability To Deliver Differentiated Client Services